Va home loan how much can i borrow calculator

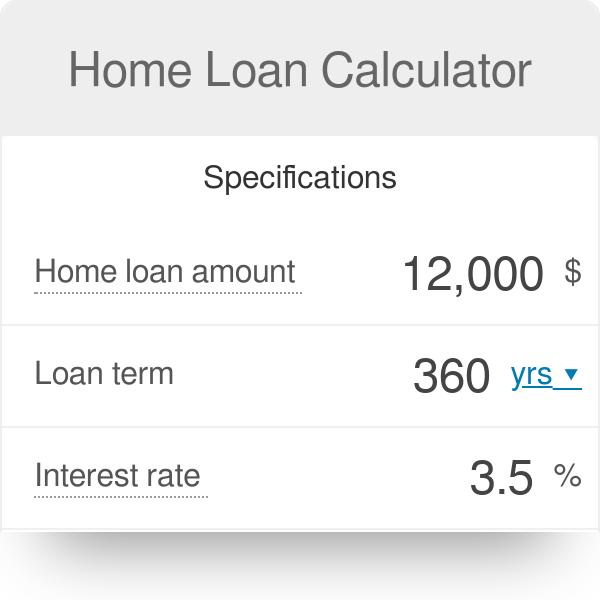

The length by which you agree to pay back the home loan. Build home equity much faster.

How Much Can I Borrow With A Va Loan

Guaranteed by the US.

. Most mortgages have a loan term of 30 years. Calculate Your Monthly Mortgage Payment. To calculate u2018how much house can I affordu2019 a good rule of thumb is using the 2836 rule which states that you shouldnu2019t spend more than 28 of your gross monthly income on home.

Homebuyers whove used a VA loan before and arent exempt from the VA funding fee typically pay a higher VA funding fee - generally 36 percent of the loan amount. Sometimes known as loan term the length of the loan is the number of years until your home loan is paid in full. The rule of thumb with most home equity loans is that you can borrow up to 80 or 85 of your homes value minus your existing mortgage balance.

The most common term for a mortgage is 30 years or 360 months but different terms are available depending on the type of home loan that works best for your situation. When comparing different loans or lines of credit make sure you clearly understand their terms and would feel comfortable with the monthly payments throughout the life of the loan or line of creditAnd if a lender says you can afford more than what youve budgeted seriously consider whether this would be a stretch for you and dont hesitate to stick to a smaller amount. You can edit your loan term in months in the affordability calculators advanced options.

Here are the pros and cons of making a down payment with a VA home loan. How Much Can You Borrow With a Home Equity. Since 2010 20-year and 15-year.

Lenders can count VA disability income and certain military allowances to determine how much you can borrow with a VA loan. Total subsidized and unsubsidized loan limits over the course of your entire education include. Once youve determined the home price that you can afford use our.

With a VA entitlement the veteran can work with the VA lender to determine how much they will be able to borrow without a down payment. 2022 VA Loan Limit Calculator. And the fee is usually included in the loan so it increases your monthly payment and adds to the interest you pay over the life of the loan.

If you are seeking a loan for a format without a front-end limit you can set the front-end box to 100 for 100 so that the calculator bases your loan limit on the back-end limit you enter. If a person stretches their loan payments out to 30-years they build limited equity in. While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan.

Once the house is built you can either repay the loan in full or. Based on the calculator output for our example you would likely be approved for a home up to 423495. Other types of military allowances that can count as effective income include.

A construction loan allows you to borrow money to build a house from the ground up. During the home construction process you make interest-only payments on your construction loan. A VA loan down payment isnt required but borrowers can still make one.

Keep in mind VA loan limits are not a maximum on how much you can borrow but help determine how much you can borrow without needing to factor in a. Essentially this entitlement is a promise to a lender that the VA will cover any losses for up to 25 of the loan amount. The amount you can borrow with any home equity loan is determined by how much equity you have that is the current value of your home minus the balance owed on your mortgage.

However the VA funding fee decreases if you put more than 5 percent down. 31000 23000 subsidized 7000 unsubsidized Independent. In many cases homebuyers can borrow up to 548250 with a VA loan but you may be able to borrow more in areas with a higher cost of living.

In December 2021 the average 30-year US. People typically move homes or refinance about every 5 to 7 years. Using our calculator above.

So if your home is worth 250000 and you owe 150000 on your mortgage you. Active duty service members receiving Basic Allowance for Housing BAH can use this income to pay for part or even all of their monthly mortgage payment. Department of Veterans Affairs VA loan carried an interest rate of 299 according to mortgage application processing software company Ellie Mae.

VA loans are for current and veteran military service members and eligible surviving spouses. Department of Veterans Affairs VA loans usually do not require a down payment. Veterans with reduced VA loan entitlement must still follow VA loan limits.

For VA loans those limits vary by county and are calculated by assessing local real estate markets. How much can I borrow with a home equity loan. Example Required Income Levels at Various Home Loan Amounts.

Youre required to pay a VA loan funding fee between 1436 of the loan amount as of 2020. 7 On a 300000 loan that fee can be anywhere from 420010800. How expensive of a home can I afford with an FHA loan.

VA loan limits no longer apply to qualified Veterans with their full VA loan entitlement.

A Dummies Graphical How To Guide To Getting A Home Loan Home Buying Process Home Improvement Loans Real Estate Tips

Va Mortgage Calculator Calculate Va Loan Payments

The Ultimate Real Estate Loan Guide Infographic Health Mortgage Payment Calculator Cleveland Clinic

Investing Calculator Borrow Money

Best Va Mortgage Calculators Navy Federal Usaa More

Use Our Mortgagecalculator To Help You Set Your Budget Price Your Payments See How Making Additional Paym Home Buying Tips Mortgage Calculator Calculators

Confused With Some Of The Terms You See In A Home Loan Agreement Don T Know What A Lock In Period Or Margin Of Loan Teaching Infographic Video Marketing

Va Loan Calculator

Va Loan Calculator Military Com

Buying A House Here Is The Home Loan Application Process If You Need Help Please Call Mortgage Choice Jody Shadg Loan Application Mortgage Mortgage Lenders

Va Loan Pre Approval Process Va Loan Mortgage Loans Mortgage Loan Calculator

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Kentucky First First Time Home Buyers Home Buying First Time

Va Loan Affordability Calculator How Much Home Can I Afford

Reverse Mortgages What To Know Visual Ly Reverse Mortgage Mortgage Info Mortgage Marketing

Home Loan Calculator House Loan Calculator

Va Loan Calculator Credit Karma

Guarantor Home Loans Borrow 105 Home Loans The Borrowers Home Buying